The Russian ruble has completely recovered from the drop suffered from the Ukraine war related sanctions imposed by the West, because people are buying it and using it as a storehouse of energy, value and gold trading proxy.

But what is it about the ruble that has attracted the attention of the world?

And can the Ruble threaten to dethrone the U.S. dollar as the reserve currency of the world?

If the answer to the above question is NO – then why are the financial markets raining cash to the exits?

On March 25th when Russia began buying gold from banks at a fixed price of 5,000 rubles (roughly $61) per 1 gram, it effectively created a gold-based exchange rate of 81 rubles to $1 and helped support the Russian currency at that time against freefall.

Now, that the Central Bank of Russia has officially tied the Russian ruble to gold as of March 28th of 2022 — the Ruble has seen its highest value during this year of instability.

The rate is 5,000 rubles per gram of gold ingots.

There are 28 grams in each ounce 28 grams for 5,000 rubles per gram is 140,000 rubles.

Are you following me this far?

The conversion rate of rubles into US dollar is 100 rubles, 90 pounds, for each US dollar.

If the rubles are tied to gold at 5000 rubles per gram, and there are 28 grams per ounce, which means that an ounce of gold would cost 140,000 rubles, then the conversion into US dollars means that gold costs 1400 dollars per ounce when used the rubles, instead of 1,928 dollars by ounce using the dollars.

If seen from the perspective of a financial market FOREX trader — Russia just wiped out about 30 percent (30%) of the US dollar value worldwide, when it comes to the market for gold ingots.

Because right now it seems to me that people all over the world are literally throwing their money on the Ruble exchanges and liquidating dollars and euros in order to do this.

And thus it seems that what Russia just did, is the financial equivalent of detonating a nuclear bomb in the financial and Forex markets.

Let me explain why this is worrisome for some.

Since, the Central Bank of Russia anchored the ruble to gold as a follow-up action to the Sanctions and the Western recourses of the war in Ukraine — the game has thickened with the Ruble gaining an all time high value.

Then it came to pass that last week, Russia said it would sell OIL and GAS only in . . . . Ruble

This means that Russian oil and gas are anchored in gold with rubles acting like a gold proxy currency.

Since Europe, badly needs Russian oil & gas — will now have to pay for its supplies by either buying rubles from Russia using gold, or paying for the oil and gas with gold itself — we now have in effect a new balance of payments.

Currently, the FOREX rate for Ruble to Dollar is around 100:1

But … with 5,000 Rubles now equivalent to a gram of Gold, and oil being priced directly into Gold, we will see a massive price disturbance in the FOREX markets, in terms of how much Gold a Dollar can still buy.

Treasuries of foreign countries, central banks, and corporates, holding T-bills, and dollar denominated U.S. debt, as well as U.S. notes as Reserve Currency — will see an immediate loss and will start using much less Reserve Currency Dollars, and will start unloading them in favour of something more stable, or something that holds its value better and longer term.

Because at this point — basically, any currency anchored in gold will fit into their account, whereas other fiat currencies will not.

This means countries like Japan, India and China – will start unloading their dollar debt as soon as possible, since they are not willing to go down with the Mothership in this battle of the Titans.

And maybe they will move to more stable values like Gold and Cash …

And obviously cash supported by Gold is King.

Yet, the only one world currency that has this is…

The Ruble.

So, when the Bank of Russia, the country’s central bank, surprisingly announced a fixed price for buying gold with Rubles, with a price of RUB5,000 (£45.12) for a gram of gold — this to my knowledge is the first time that a nation’s currency has been expressed in “gold parity” since Switzerland decided to stop doing so back in 1999.

Enacting gold parity was common practice by the world’s major powers for facilitating international trade payments in the era of the gold standard in the 19th and early 20th centuries. The same was true in a slightly different way during the Bretton Woods era from 1944 until 1971, which was when US President Nixon decided to end the system by removing the link between gold and the US dollar.

Putin’s new arrangement is envisaged, initially, to hold from March 28 to June 30. It is the latest in a series of rouble-related moves by the Russians, starting with the announcement on March 23 that they would only accept Rubles for European gas instead of euros and US dollars, seemed to me that Russia would at least extend this policy to oil, but it has gone further and signaled an intention to make it apply to all the commodities it exports (others include wheat, nickel, aluminum, enriched uranium and neon).

The main goal of these moves is to try to ensure the credibility of the rouble by making it more desirable in the forex market, though it also fits into longstanding attempts by Russia and China to weaken the US dollar’s dominance as global reserve currency (meaning it’s the currency in which most international goods are priced and which most central banks hold in their foreign reserves).

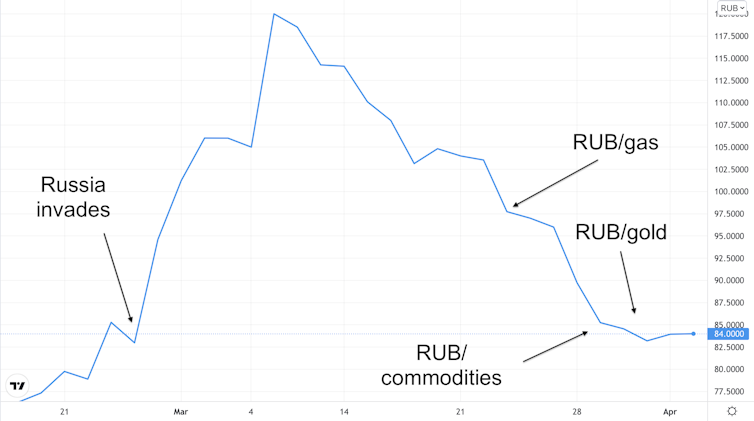

As one can see in the chart below, the rouble collapsed in late February and early March when western sanctions were imposed in response to Russia’s invasion of Ukraine (the collapse looks like a rise in the chart because it’s showing the number of roubles to the US dollar rather than the other way around).

Rouble/USD chart

After the big drop, the Ruble recovered somewhat, which is typical in such situations (known in the literature as “exchange-rate overshooting”). However, the currency strengthened further after the roubles-for-gas announcement (no matter how serious or implementable the plan actually is – so far, there has been resistance to Putin’s new rules).

On the back of the gold announcement, the currency has continued to strengthen to about RUB83 to the dollar. As precious metals go — this makes sense if you reflect that the market price of a gram of gold is currently about US$62 (£47.20). That’s fairly close to Putin’s announcement that 1 gram of gold equals RUB5,000, which effectively creates a gold-based exchange rate of RUB81 to US$1.

Previous gold-based systems

To give a sense of the similarities with the gold standard and the Bretton Woods system, let me draw a historical parallel. The UK’s Coinage Act of 1816 fixed the value of the pound sterling to 113 grains of pure gold, while the US Gold Standard Act of 1900determined that the dollar should maintain a value of 23.22 grains of pure gold. Taken together, the two acts implied an official gold parity exchange rate of £1 = US$4.87.

It was similar during the post-war Bretton Woods era: 1 ounce of gold was said to be worth US$35, and all other currencies were fixed to and convertible into the US dollar. Gold was at the centre of the system as a way of making money credible.

Of course, attaching the Ruble to a gold standard comes with certain “rules of the game” that Russia will have to abide by. It should be willing to exchange gold for roubles with anyone who wants to do so.

This was what the US did during the Bretton Woods era, and it led to the system’s demise: with US expenditure rising to wage the Vietnam war, dollar holders became increasingly nervous about the dollar’s value and sought to exchange it for gold.

Nixon’s unilateral decision to end convertibility was for fear that the US would run out of gold, which would have destroyed the credibility of the dollar. Since that decision, the world has moved to a system of floating exchange rates and the price of gold has steadily risen as world currencies have become weaker in relation to it. The system has effectively been supported by a deal that the Americans struck in the early 1970s to buy oil from the Saudis and give them military support in exchange for the Saudis using the dollars to buy US government bonds.

Gold price (US$/ounce)

The problem for Russia is that if it is willing to exchange roubles for gold, it could soon end up in a similar situation to the US circa 1971. Wars are an abnormal state of affairs which come with huge uncertainty: no reliable forecasts are possible, and markets are liable to overreact to new developments – particularly in the short term. If confidence in the rouble falls again, many investors might decide to withdraw gold from the central bank, which could be extremely destabilising for Moscow.

The viability of Russia maintaining a fixed rate of roubles for gold is closely related to what happens to demand for Russian energy. If the west can only slowly substitute away from its dependence on Russia’s oil and gas, then demand for roubles will help to keep the currency propped up (especially if the west does end up paying in roubles).

But if politicians listen to economists and immediately stop importing Russian gas, oil and other commodities, the rouble could fall dramatically – along with the whole Russian economy. As much as this would cause a further spike in prices and pain all round, it may be the most efficient and perhaps even safest way to induce Russia to stop the war.

Yours,

Dr Churchill

PS:

Since Russia has put its currency on the gold standard — it basically declared the Ruble a hard gold substitute at a fixed exchange rate.

Now, everyone is looking at it, because when a currency is backed by gold rather than the US dollar — it might be seen as becoming more stable and maybe a bit stronger.

As for Russia, with a strong ruble backed by gold — Putin would simply be in a position to insist on payment for Russian commodities in rubles.

So, each time any European country pays Russia in Rubles or gold — it will simply end up strengthening the Ruble’s position even more.

Apparently, with this latest move, the rubble over the Ruble is not over by any means, but a stable currency for Russia means that good things might start to happen soonest.